WIC uses four strategies spanning the risk spectrum to manage our clients’ assets. All strategies are researched and managed in-house. Our investment committee averages 23 years of portfolio construction experience, including three CFAs. WIC’s portfolio managers and their families are invested in the same strategies as our clients; it should be no other way.

The WIC Fixed Income Strategy is designed for clients whose first priority is preservation of capital and who prefer reduced equity exposure. It is designed to provide a reliable income stream and reduced volatility, while capitalizing on corporate bond yields and minimizing realized losses.

We pay particular attention to the duration of our Fixed Income Strategy. The Strategy’s duration is generally lower than the Barclays Capital Aggregate Index, meaning the Strategy tends to experience less volatility as interest rates change. While maintaining a below average duration is a primary objective, we also aim to have a higher yield than the Barclays Capital Aggregate Index.

We employ our Fixed Income Strategy for clients with the following needs:

- Basic diversification

- Preservation of capital

- Short-term capital needs

- Defined longer-term capital needs

- Portfolio ballast during market volatility

- Returns slightly higher than inflation, with low volatility

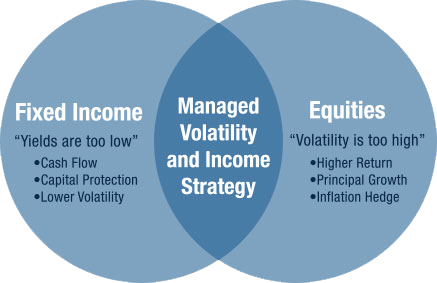

The Managed Volatility and Income Strategy (MVIS) offers investors exposure to equity market returns and enhanced yield while hedging market volatility.

WIC’s Managed Volatility and Income Strategy maintains broad diversification by investing in 50+ U.S. traded stocks. No single company has more than a 2.25% weight in the portfolio, and the portfolio is diversified among sectors. As a way to reduce risk, we sell covered call options on every stock in the portfolio. The Strategy’s net exposure typically ranges from 55 –65%.

The portfolio has well-defined construction parameters, with fundamental analysis performed on each company. Equity selection focuses on historical dividend records and the probability of sustained and growing dividends.

We have two objectives:

(1) Lower volatility and reduced net stock market exposure achieved by selling covered calls on each holding

(2) Above-average portfolio cash flow provided by dividends and option premiums

Portfolio cash flow is the dominant source of return and is achieved by investing in relatively high-quality, high dividend-yielding equities and selling “out-of-the-money” covered call options against those equities.

![]()

The Managed Volatility and Income Strategy is a relatively defensive way to own equities and is a less complex strategy compared to alternative strategies such as hedge funds. This strategy is suitable as an equity component, a fixed income component, or a hedged strategy. It is used by foundations, endowments, family offices, corporations, pension funds, and high-net worth individuals.

For more information about this strategy, please read Alternative to Alternatives.

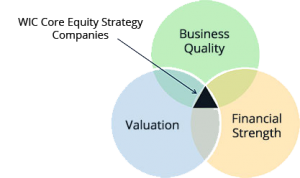

Willis Investment Counsel has managed its Core Equity Strategy for over 40 years. Our approach relies on fundamental, bottoms-up research to identify companies that we believe are sufficiently undervalued yet have acceptable risk profiles. The Strategy usually holds 35—50 broadly diversified, mid/large cap equities, with an average position size of 2—4%.

At least 75% of the portfolio contains basic companies that we believe will compound value over extended periods of time via strong internal growth rates. We will invest up to 25% in contrarian & deep cyclical companies if the risk/reward opportunity is extraordinary.

When considering companies, we actively screen for financial strength, sustained profitability, free cash flow durability, and competitive position in essential industries, with an emphasis on understandable businesses and risk-reflective capital appreciation potential.

While there are many paths to investment success, we believe our strategy of owning financially strong, market-leading, undervalued companies for long periods has and will produce successful outcomes for our clients.

Furthermore, our investment strategy is in alignment with our efforts to actively practice good investment behavior, which entails promoting patience throughout our investment process and practicing gradualism with regards to trading and long holding periods.

WIC’s Small Cap Value Strategy seeks long term growth of capital by investing in companies that we believe can compound capital over long periods of time. The Strategy generally holds 25-35 companies, with a typical position size of 2—5%. We seek to employ gradualism when establishing and exiting ownership in a company. We target smaller companies (market caps), but also invest in mid-sized companies.

When considering companies to own, we seek financially strong companies that are market leaders and have a track record of positive earnings and cash flow. We target companies that have above average returns on capital and returns on equity, particularly those whose return on capital significantly exceeds cost of capital. We use proprietary models to value these companies over long periods of time. We do not rely on one model, but rather use multiple methods to triangulate the intrinsic value of a company.

We own companies for a long time. We believe our very long-term philosophy empowers us to think more like business owners, reduces behavioral risks, and empowers us to initiate ownership in a company for which we have conviction in their 5+ year path. We aim to maintain a diversified portfolio through basic economic sector, company weighting, and by understanding the true economic drivers of each of our companies.

There is no guarantee that these strategies will achieve their stated goals and they are subject to customary investment risks and uncertainties. There will be years of negative returns and loss of principal may occur. Past performance is not predictive of future results.